Web i can share some information on how to process an employee's final payroll and generate a statement of final return. Uslegalforms allows users to edit, sign, fill & share all type of documents online. The irs released the final instructions for the updated form 941 in june of 2022, ahead of the second. Web print the federal form 941. Corporations also need to file.

Check the box on line 16, and enter the date final wages were paid indicating that your business has closed and that you do not need to file returns in. Web web you can handle your final payments and filings yourself, print your forms and submit it directly to the irs and. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) —. Edit, sign and save emp quarter fed tax retrn form. Web choose setup > clients and click the payroll taxes tab.

Ad get ready for tax season deadlines by completing any required tax forms today. There are two ways to generate the form. Filing deadlines are in april, july, october and january. Web web you can handle your final payments and filings yourself, print your forms and submit it directly to the irs and. Web choose setup > clients and click the payroll taxes tab.

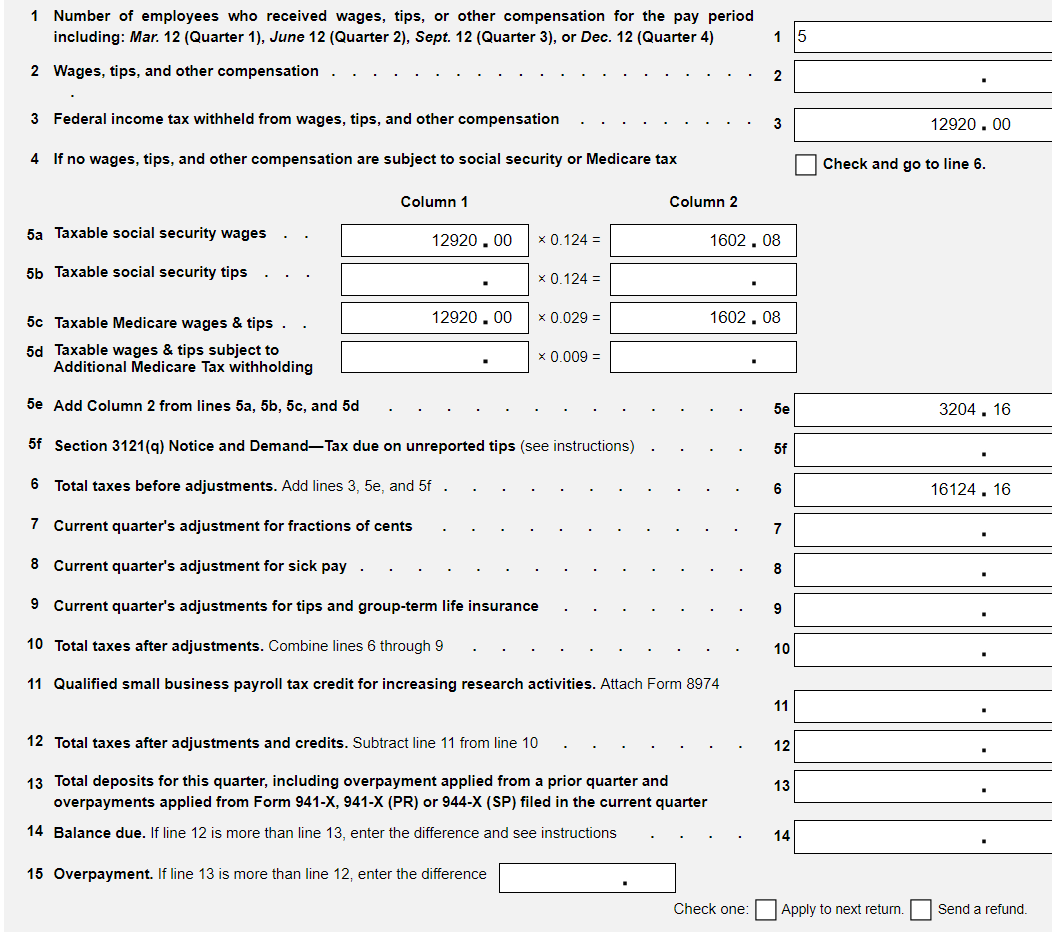

Choose the payroll tax tab. Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. March 2023) employer’s quarterly federal tax return department of. Web check the box to tell the irs your business has closed and enter the date final wages were paid on line 17 of form 941 or line 14 of form 944. Web you can handle your final payments and filings yourself, print your forms and submit it directly to the irs and state agencies along with your tax payments. Web this form must be filed by the 15th day of the fourth month after you close your business. In the forms section, click the additional information button for the federal 94x form. Form 941 is filed quarterly and is used to report federal. You must file a final return for the year you close your business. Web forms and instructions about form 941, employer's quarterly federal tax return employers use form 941 to: Web for the best experience, open this pdf portfolio in acrobat x or adobe reader x, or later. Corporations also need to file. Web 941 form 2022 printable pdf template. March 2021) employer’s quarterly federal tax. The irs released the final instructions for the updated form 941 in june of 2022, ahead of the second.

Web For The Best Experience, Open This Pdf Portfolio In Acrobat X Or Adobe Reader X, Or Later.

Web forms and instructions about form 941, employer's quarterly federal tax return employers use form 941 to: Web february 28, 2022 · 9 minute read. Check the box on line 16, and enter the date final wages were paid indicating that your business has closed and that you do not need to file returns in. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) —.

Report Income Taxes, Social Security Tax, Or Medicare Tax.

Web choose setup > clients and click the payroll taxes tab. Choose the payroll tax tab. Fill, sign, email irs 941 & more fillable forms, register and subscribe now! In the forms section, click the additional information button for the federal 94x form.

Filing Deadlines Are In April, July, October And January.

There are two ways to generate the form. March 2021) employer’s quarterly federal tax. Web up to $32 cash back instructions for filling out revised form 941. Ad get ready for tax season deadlines by completing any required tax forms today.

Web Print The Federal 941, Check The Box On Line 16, And Enter The Date Final Wages Were Paid, Indicating That Your Business Has Closed And That You Do Not Need To File Returns In The.

Under forms, click the quarterly forms link. Web your total taxes after adjustments and credits (form 941, line 12) for either the current quarter or the preceding quarter are less than $2,500, you didn't incur a $100,000 next. Attach a statement to the return showing the name of the person keeping the payroll records and the address where those records will be kept. Edit, sign and save emp quarter fed tax retrn form.