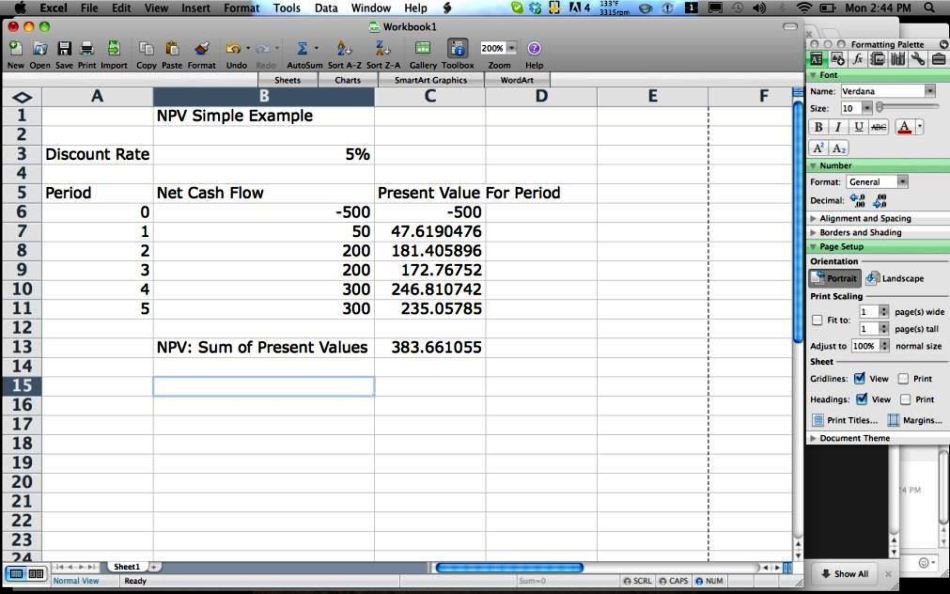

Ad enjoy great deals and discounts on an array of products from various brands. Present value of a single cash flow. While you can calculate pv in excel, you can also calculate net present value(npv). All future cash flows must be discounted to the present using. Web examples of present value formula (with excel template) let’s take an example to understand the present value’s calculation better.

While you can calculate pv in excel, you can also calculate net present value(npv). Here is a screenshot of the net. Ad enjoy great deals and discounts on an array of products from various brands. Web this net present value template helps you calculate net present value given the discount rate and undiscounted cash flows. Present value is discounted future cash flows.

Net present value is the difference between pv of cash flows and pv of cash outflows. Pv = fv (1 + i)n p v = f v ( 1 + i) n. I = interest rate per period in decimal form. Learn new skills with a range of books on computers & internet available at great prices. Ad embarkwithus.com has been visited by 10k+ users in the past month

Net present value is the difference between pv of cash flows and pv of cash outflows. Ad embarkwithus.com has been visited by 10k+ users in the past month Learn new skills with a range of books on computers & internet available at great prices. Web the present value formula. Web npv is an essential tool for corporate budgeting. Web in simple terms, npv can be defined as the present value of future cash flows less the initial investment cost: I = interest rate per period in decimal form. In doing so, you can calculate. Web this present value calculator can be used to calculate the present value of a certain amount of money in the future or periodical annuity payments. All future cash flows must be discounted to the present using. Use the excel formula coach to find the. An npv of zero or higher forecasts. It is used to determine the. Thanks to this formula, you can estimate the present value of an income. Web this net present value template helps you calculate net present value given the discount rate and undiscounted cash flows.

An Npv Of Zero Or Higher Forecasts.

Present value of a single cash flow. Web the present value (pv) is an estimation of how much a future cash flow (or stream of cash flows) is worth right now. The first worksheet is used to calculate present value based on interest rate, period and yearly payment. It is used to determine the.

Web Npv Is An Essential Tool For Corporate Budgeting.

Ad embarkwithus.com has been visited by 10k+ users in the past month Web in simple terms, npv can be defined as the present value of future cash flows less the initial investment cost: Web the present value formula. Ad enjoy great deals and discounts on an array of products from various brands.

Pv = Fv (1 + I)N P V = F V ( 1 + I) N.

Thanks to this formula, you can estimate the present value of an income. Web up to 50% cash back let's walk through an example of using the excel pmt function in wps for a monthly loan payment calculation. If you want to calculate the present value of a single investment that. Present value is discounted future cash flows.

Web The Net Present Value (Npv) Of An Investment Is The Present Value Of Its Future Cash Inflows Minus The Present Value Of The Cash Outflows.

Web examples of present value formula (with excel template) let’s take an example to understand the present value’s calculation better. Web present value calculator itself will help you to calculate the exact value of the future investment as if it existed in the present day. I = interest rate per period in decimal form. Web calculates the net present value of an investment by using a discount rate and a series of future payments (negative values) and income (positive values).